Case Study: Allapattah 3-Unit Multifamily Acquisition

This is the first of what I hope to be a series of articles that highlights past deals. It is meant to give a more in depth analysis of the performance of some of our investments as well as give a general overview of the types of opportunities that we look for.

Type of Investment: Short-Term Value-Add, Buy & Hold

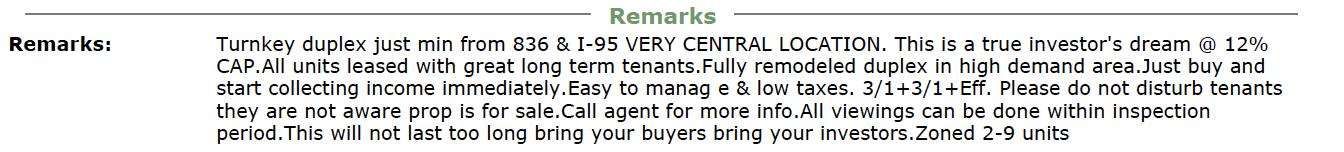

Overview: This particular property was a 3-Unit Multifamily in Allapattah, a well-known neighborhood in Miami that is a hotbed for investment as of the writing of this article. We found the property on the MLS, being advertised as a duplex with a 12% cap rate. Here is an excerpt from the listing:

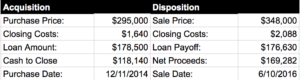

When I arrived at the property, the listing agent quickly revealed that although this was a duplex, it had a third “efficiency” unit which was generating an additional $900 per month in income. The efficiency was not done with permits and therefore was not legal, but the only thing standing in the way between making this property legal again, was a door in between the front unit and the efficiency that had been sealed, which could have easily been reopened. I didn’t see this as a problem so I proceeded to make an offer. We eventually settled on a price of $295,000. We took out a conventional loan from Ocean Bank for $176,500 (60% LTV). The LTV would have been higher, but Ocean Bank did not take the income from the illegal efficiency into account and decided they would rather reduce the LTV.

During Due Diligence it became evident that this property was not being managed correctly. The landlord had been paying utilities which was creating additional, unnecessary expenses, and I found out later that the tenant in the efficiency was the ex-Husband of the seller who had been living there rent free with a couple of buddies (in a 100 sq ft efficiency!).

Opportunity: The key to unlocking the true value of this property was in property management. By putting the right tenants in and implementing the correct and most efficient processes, along with cutting down the operating expenses, we could potentially raise the value of this property by increasing the cash flow. This was NOT a 12% cap rate by any means (most agents in Miami tend to inflate their numbers so do your own calculations!).

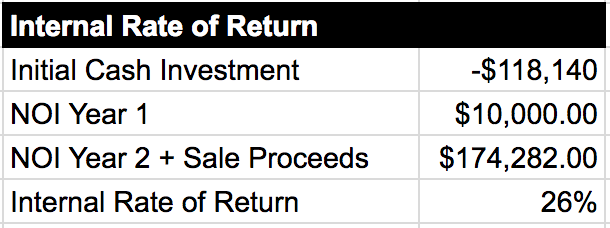

By the time we sold the property 16 months later, we had replaced 2 of the 3 tenants, renegotiated the lease agreements so that tenants would have to cover all utilities, and implemented Buildium (a property management software) to manage rent collection, late fees, maintenance requests, etc., essentially turning this property into a well-oiled, consistently cash-flowing machine. We sold it for $348,000 after collecting 16 months worth of positive cash flow from rental incomes. This amounted to an Internal Rate of Return of 26%.

Financial Breakdown:

Conclusion: The key to multifamily investments is to find the opportunities to add value to the property by increasing the quality of the tenants, implementing a streamlined process, and finding ways to reduce operating expenses. In this case we were able to do this within 16 months and cash out the equity we created via forced appreciation in order to reinvest in more deals. We also passed on a cash-flowing, hard asset to another investor. We are still in touch with him to this day; he still owns the property and is very happy to have purchased it.

Property Photos: